We’ve been busy behind the scenes this past month, so here’s our update!

In the first part of the month, we learned that once we are approved by the IRS for our tax donations to be tax-deductible, we still have to register in each individual state to likewise accept donations. Which is a pain, but we’ll manage it.

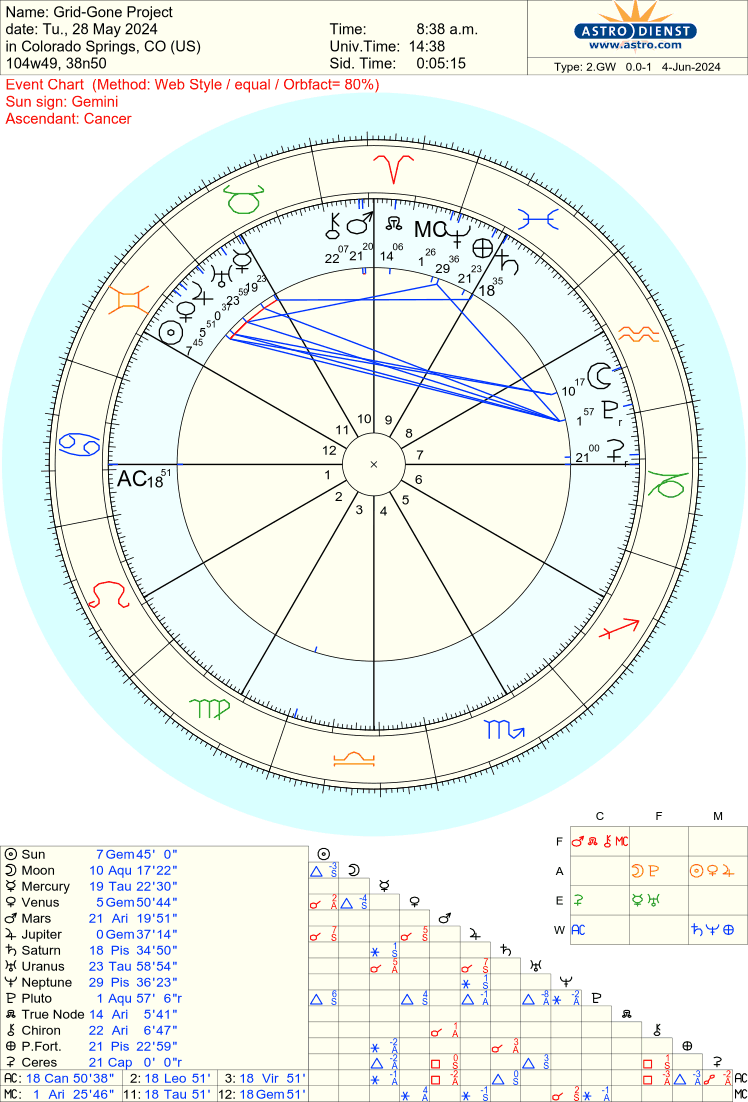

At the end of the month, we officially filed out Articles of Incorporation in the state of Colorado! For those interested, here’s the astrological chart of the moment of our filing, below

Next Steps:

Our next step is to complete and submit the IRS Form 1023, which is what is required to be approved for tax-deductible donations. We will be working on this tomorrow, at least, and maybe a few more days after that, since it requires us to estimate donations, revenues, and expenses not only for this year, but for the next two years. Which it one the one hand, understandable, but on the other… how do we estimate donations and revenues when we currently, at the moment, have none? (Other than the pledged amounts for the legal fees.) We’ll figure it out.

Once the 1023 is filed, it’ll be time to really focus on the Kickstarter for the Knowledge Network! I’ll post more on that idea in posts to follow.

That’s the update for now! More coming soon!

TUNE IN NOW

Now Available! Put your latest podcast or offer here